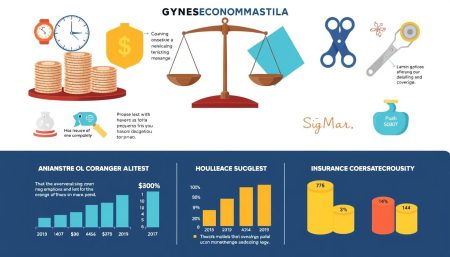

Dealing with gynecomastia is tough, both physically and financially. Knowing how to get gynecomastia insurance coverage is key to getting affordable gynecomastia surgery. This guide will help you understand how to get insurance for this important surgery. We’ll look at the gynecomastia treatment options and how to make sure they’re covered by insurance.

Key Takeaways

- Learn the basics of getting insurance for gynecomastia surgery.

- Find out which gynecomastia treatment options insurance covers.

- Understand the details of insurance coverage for gynecomastia.

- Discover ways to fight for affordable gynecomastia surgery.

- Use available resources to learn about the coverage process and what’s needed.

- Be ready to talk about insurance with your healthcare team.

- Get the knowledge you need to overcome financial hurdles to treatment.

Understanding Gynecomastia and Its Treatment

Gynecomastia affects not just physical health but also emotional well-being. By understanding its causes and exploring treatments, those affected can manage and possibly reverse it.

What is Gynecomastia?

Gynecomastia is when a male’s breast tissue grows too much. It can happen in one or both breasts, sometimes unevenly. It’s common in newborns, teenage boys, and older men.

This condition can cause a lot of emotional pain and discomfort. It’s important to find effective treatments and offer support.

Common Causes of Gynecomastia

The causes and symptoms of gynecomastia vary. Hormonal imbalances are a big reason. Too much estrogen or too little testosterone can cause it.

Being overweight, some medicines, and health issues like liver disease can also cause it.

Treatment Options Available

There are many ways to manage gynecomastia, from medicine to surgery. Surgery can remove excess tissue and give a more masculine chest shape.

For mild cases, non-surgical treatments might work. These include exercise, diet changes, and medicine to fix hormonal imbalances.

Here’s a comparison of non-surgical and surgical treatments:

| Treatment Type | Details | Expected Outcome |

|---|---|---|

| Medication | Targets hormonal balance | May reduce tissue size |

| Lifestyle Changes | Exercise and dietary adjustments | Potentially modest improvements |

| Male Breast Reduction Surgery | Removes excess fat and glandular tissue | Permanent, significant contouring of the chest |

Male breast reduction surgery is often the best choice for serious cases. But, always talk to a doctor before choosing a treatment.

Insurance Coverage for Gynecomastia Surgery

Learning about insurance for gynecomastia surgery starts with knowing the different insurance plans. It’s important to understand what each plan covers and how they decide if a surgery is eligible. The goal is to figure out how to get gynecomastia surgery covered by insurance and understand the costs involved.

Types of Insurance Plans

Insurance plans vary a lot, each with its own rules. You’ll find HMOs, PPOs, EPOs, and POS plans. These plans affect how much of the gynecomastia surgery cost you’ll cover and who you can see for care.

Factors Influencing Coverage Decisions

Insurance companies look at several things when deciding to cover gynecomastia surgery. They check if the surgery is needed, if you’ve tried other treatments, and if your symptoms are serious. Knowing what your insurance needs can help you get coverage for how to get gynecomastia surgery covered by insurance.

| Insurance Type | Coverage for Gynecomastia Surgery | Documentation Required |

|---|---|---|

| HMO | Yes, with referral | Referral from PCP, documented medical history of symptoms |

| PPO | Yes, with pre-authorization | Medical history, prior treatment records |

| EPO | Possible, selective network | Symptom documentation, specified provider confirmation |

| POS | Yes, if part of network and pre-approved | Detailed medical history, proof of necessity |

With this information, you can talk to your insurance provider better. Knowing about your policy and what you need can help get your gynecomastia surgery cost covered. It’s key to check your policy or talk to an insurance rep for your specific situation.

Steps to Prepare for Insurance Approval

When preparing for gynecomastia surgery, getting insurance approval is key. It needs careful planning and organization. The success depends on the quality of your documents and medical history.

Gathering Necessary Documentation

Getting the right documents is the first step. These documents are the base of your insurance claim. They should include medical records, test results, and any past treatments for gynecomastia. Make sure all papers are up-to-date and detailed.

Importance of a Detailed Medical History

A detailed medical history is crucial. It shows your health and why the surgery is needed. Include when gynecomastia started, any symptoms, and how it affects you.

If your claim is denied, good documentation helps in appeals. Without insurance, look into gynecomastia surgery financing options. This could be medical loans, payment plans, or health care credit cards. They help cover surgery costs without needing to pay everything upfront.

Consulting with Your Healthcare Provider

Choosing the right healthcare provider for gynecomastia surgery is key. It’s important to talk about all your surgery expectations and needs. This ensures both you and your provider are on the same page. It also helps with insurance coverage.

Choosing the Right Specialist

It’s crucial to find a specialist who knows gynecomastia surgery well. Look for a board-certified plastic surgeon with lots of experience. This ensures top care and helps understand insurance details better.

Discussing Your Concerns and Goals

Talking openly with your healthcare provider is vital. Share your reasons for surgery and what you hope to achieve. This can greatly affect how happy you’ll be with the results.

| Concern | Discussion Topic | Importance |

|---|---|---|

| Physical Discomfort | Extent of physical pain and limitations in daily activities. | High |

| Psychological Impact | Feelings about body image and the psychological benefits of surgery. | Medium |

| Expected Results | What to anticipate in terms of surgical outcome and scarring. | High |

| Recovery Process | Time needed for recovery and any help required during recovery. | Medium |

| Insurance Coverage | Understanding of what is covered by insurance and the necessary documentation. | High |

Essential Criteria for Medical Necessity

Understanding what makes gynecomastia surgery medically necessary is key. Insurers compare the gynecomastia surgery cost to set criteria to decide on claims. Knowing these criteria well can help a lot when trying to get coverage.

Defining Medical Necessity for Your Insurance

Insurance companies use clinical guidelines and cost-effectiveness to define medical necessity. They look at symptoms, failed gynecomastia treatment options, and discomfort. It’s important to show how gynecomastia affects your daily life.

How to Present Your Case to Insurers

Being clear and detailed is crucial when talking to insurers. You need to share medical records, healthcare provider statements, and proof of failed treatments. It’s about showing that surgery is not just helpful but necessary.

Insurers can interpret medical necessity differently. Knowing your plan’s specifics can help a lot. It’s wise to talk to a healthcare provider who knows about insurance and gynecomastia surgery cost.

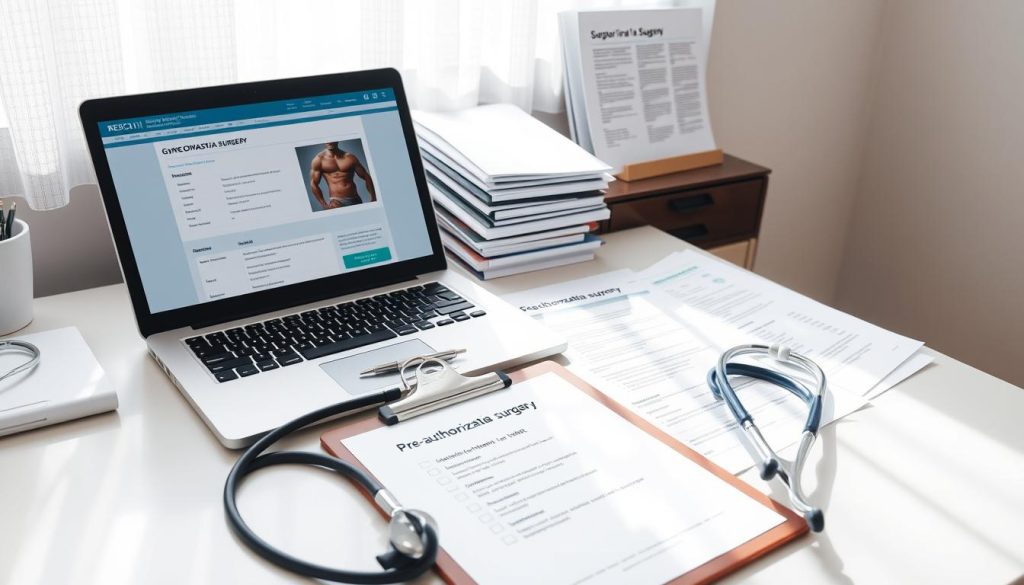

Navigating the Pre-Authorization Process

Starting your journey to gynecomastia surgery means going through the pre-authorization process. This step is key to getting your insurance to cover the costs. It helps you financially by making sure your insurance will help pay for it.

What is Pre-Authorization?

Pre-authorization is when your insurance checks if you really need gynecomastia surgery. It’s important to see if your surgery is covered by your insurance. This is how your insurance says it’s okay to get certain medical treatments before you get them.

Tips for Successfully Securing Pre-Authorization

To get pre-authorization and find ways to pay for gynecomastia surgery, follow these tips:

- Gather comprehensive medical documentation that shows why you need surgery. This should include notes from doctors who say you need it.

- Understand your insurer’s criteria for coverage. Make sure your situation meets their rules. Reading your policy carefully can help you know what you need.

- Prepare a clear and concise case for why you need surgery. Focus on how it’s needed for your health, not just to look good.

- Get help from a medical advocate or a surgeon. They can give strong reasons why you need surgery.

- Follow up persistently with your insurance. Keep them updated on your status and answer any questions they have quickly.

By following these tips, you can improve your chances of getting pre-authorization. This makes the financial part of your surgery journey easier.

Appeal Process for Denied Claims

Getting a denial for a gynecomastia surgery claim can be tough. But, the appeal process offers a clear way to challenge the decision. Knowing how to navigate this process can greatly improve your chances of overturning the denial. It also helps you understand gynecomastia insurance coverage better.

Steps to Take After a Claim Denial

After a denial, it’s important to act quickly. First, look at the reasons given for the denial. Get a copy of your policy and check if your coverage matches these reasons. Also, collect any extra medical documents that show why the surgery is needed, proving you’re covered for gynecomastia insurance coverage.

Crafting a Strong Appeal Letter

Your appeal letter is key. It should be detailed, explaining why you disagree with the denial and providing evidence. Include medical records, a treatment history, and statements from doctors who say the surgery is necessary.

For tips on writing a strong appeal letter, check out expert resources. They offer advice and templates to help you.

| Key Component | Description | Importance |

|---|---|---|

| Reasons for Denial | Specific reasons cited by insurance for claim rejection | Essential for tailoring your appeal strategy |

| Medical Documentation | Additional reports and records that underscore the necessity of surgery | Crucial for substantiating the medical basis of the claim |

| Professional Statements | Insights from medical professionals who recommend the surgery | Strengthens the medical argument for the procedure |

While preparing your appeal, also look into gynecomastia surgery financing options. Many places offer loans and payment plans for healthcare. These can be useful if your appeal doesn’t work out.

Understanding the appeal process and how to handle it can greatly help your recovery. It’s a tough journey, but being informed and ready can lead to getting the insurance and treatment you need.

Financial Assistance Options If Denied

When insurance doesn’t cover gynecomastia surgery costs, it can feel overwhelming. But, there are many financial help options available. These options make it easier to get affordable surgery and manage costs.

Alternative Payment Methods

Looking into other payment ways is key when insurance says no. Many clinics offer payment plans that let you pay a bit at a time. This makes things easier on your wallet. Some hospitals even have special packages that cover everything from before surgery to aftercare.

Resources for Financial Support

There are groups and foundations that give out money or help for gynecomastia surgery. These are great for cutting down what you have to pay out of pocket.

| Resource | Type of Assistance | Contact Information |

|---|---|---|

| Healthwell Foundation | Financial Assistance | healthwellfoundation.org |

| PAN Foundation | Co-payment Assistance | panfoundation.org |

| The Assistance Fund | Medical Expense Aid | tadfund.org |

Finding and using these resources can really help. It lets you focus on getting the surgery you need without worrying too much about money. By looking into these options, getting affordable gynecomastia surgery becomes more possible.

Preparing for Post-Surgery Insurance Tasks

Getting gynecomastia surgery is a big step, but the real work comes after. It’s not just about changing your body. It’s also about dealing with insurance to make sure your care is covered. Knowing how insurance works with gynecomastia surgery is key.

We’ll guide you through the steps to handle your insurance after surgery. This will help you avoid any surprises and keep your focus on getting better.

Documentation for Insurance Claims Post-Surgery

After surgery, having the right documents is crucial for your insurance claims. Keep a detailed file with all necessary forms and medical records. Include photos that show why the surgery was needed.

These documents prove you met the surgery’s requirements. They show the surgery’s importance for your health, not just looks. This helps insurance companies understand the surgery’s impact.

Following Up on Your Claim Submission

It’s important to stay on top of your insurance claims. Regularly check in with your insurance company. This helps avoid delays and answers any questions they might have.

Being proactive and talking directly to claims processors can help. If they ask for more info, respond quickly. This makes the process smoother and shows you’re working together.

FAQ

Q: What are the initial steps to get gynecomastia surgery covered by insurance?

A: First, understand your insurance plan’s coverage. Check if gynecomastia surgery is considered elective or medically necessary. Get a diagnosis and documentation from your doctor that shows the surgery’s medical need.

Q: What causes gynecomastia, and how can I identify it?

A: Gynecomastia can be caused by hormonal imbalances, certain medications, weight gain, and health conditions. Symptoms include enlarged breast gland tissue and tenderness. A medical evaluation is needed for a correct diagnosis.

Q: What are my treatment options if I am diagnosed with gynecomastia?

A: Treatment options include watchful waiting, medication, and male breast reduction surgery. The right choice depends on the symptoms’ severity and cause.

Q: How is the cost of gynecomastia surgery impacted by insurance coverage?

A: The cost of surgery can change based on insurance coverage. If your plan covers it, the cost might be lower. Even with coverage, you might still have to pay out-of-pocket, but insurance can help reduce the cost.

Q: What are the essential documents needed for insurance pre-approval of gynecomastia surgery?

A: You’ll need a detailed medical history and proof of necessity from your doctor. This includes physical exam notes and medical images. Also, any previous treatments for gynecomastia are important.

Q: How do I choose the right specialist for my gynecomastia treatment?

A: Choose a board-certified plastic surgeon with gynecomastia experience. Research their background, reviews, and before-and-after photos. A consultation is also key to discuss your surgery goals and concerns.

Q: What constitutes ‘medical necessity’ for gynecomastia surgery in terms of insurance?

A: ‘Medical necessity’ means the surgery is needed for physical discomfort, pain, or social issues. It also means other treatments have failed.

Q: How does the pre-authorization process work for getting gynecomastia surgery approved?

A: The pre-authorization process involves your doctor submitting evidence to your insurance. This includes your medical history, failed treatments, and potential risks without surgery.

Q: What should I do if my insurance claim for gynecomastia surgery is denied?

A: If your claim is denied, review the reasons and talk to your doctor for more information. Consider filing an appeal. A detailed appeal letter with strong medical evidence can help.

Q: What financial assistance options exist if I can’t get insurance coverage for gynecomastia surgery?

A: Options include medical loans, payment plans, and third-party financing. You can also look into charity cases or surgical grants for financial help.

Q: What post-surgery insurance tasks should I be prepared for?

A: After surgery, keep all medical records and receipts. Submit claims to your insurance and follow up to ensure timely processing.